life is so short, I know, 3 bereavements in 18 months. We saved for a comfortable old age for me and my husband, now I am one and I have enough for care if ever needed, so I buy what I want when I want it. I could spend loads on holidays but don`t really fancy a holiday, happy to have nice food, pottering and days out.

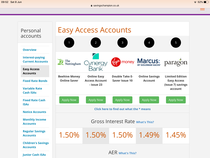

I do still keep an eye on savings rates eg yorkshire has gone down to very low, so I transferred the lot to virgin. Tbh I cannot really be bothered to open new accounts. I like premium bonds and the tax free prizes too. I look after the sipp, decided to change from shares to safe and steady income, being my age and having to be risk averse. The excitement of share trading has gone but served us well in the past